- Today’s Rate Menu: After a three-week hiatus, variable mortgage rates are back down to prime – 0.50% (a 1.95% effective rate, including cash back) in some provinces—but only if you need a default-insured mortgage. The lowest widely advertised uninsured rates remain HSBC’s 2-year fixed at 2.34% and the fully open Tangerine HELOC at 2.35%.

- Sales Should Surge Post-Reopening: Home purchases have fallen precipitously, but it’s worth repeating that coronavirus is temporary, says broker Ron Butler of Butler Mortgage. “What happens when the Covid lockdown eases?” he asks. “It’s safe to assume there will be a burst of pent up purchase activity. Some [events] require a home sale: marriage breakdown, job transfer, family growth, sadly even the death or disability of the homeowner. So, postponed transactions have to happen…End of lockdown will result in a very busy 6 to 8 weeks.” But after that, it’s likely the devastating economic consequences of COVID will mute real estate activity for the balance of 2020 and likely part of 2021, he adds. “You just can’t shatter economic activity the way COVID has and expect zero long-term effects.”

- Inflation Nation?: There’s not much disagreement that the next several quarters will see disinflation or deflation, and historically low mortgage rates. But be warned, says C.D. Howe’s Jeremy M. Kronick. Despite an inflation slowdown for as far as the eye can see, there will come a bottom. “Canadian financial institutions are not generally using [the] massive increase in their reserves [from BoC asset purchases] to expand lending, which would lead to a commensurate increase in inflation. Should this change, however, such a huge increase in the money supply will eventually be highly inflationary, with more money chasing after a limited supply of goods.”

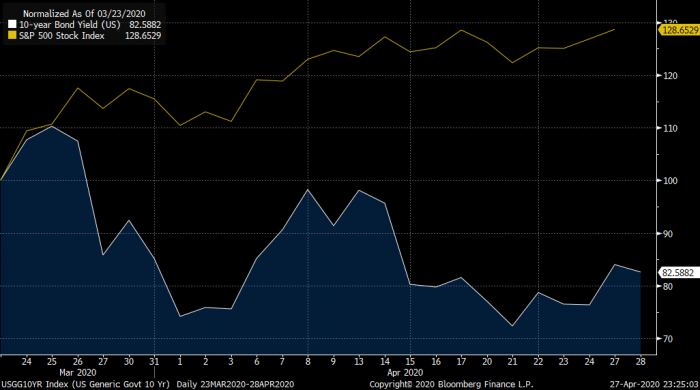

Of course, analysts have said this kind of thing for years amid surging government debt/deficits. The issue with this sort of “advice” is that even if it’s true, it doesn’t come with a “take action” date. It’s kind of like predicting a catastrophic earthquake. Eventually you’re going to be right, but you can’t stop living while you wait for it. - Who Holds the Truth? Once again there’s a mega divergence between the stock market and (the bigger) bond market. Stocks are up 28% since the cycle bottom on March 23. Meanwhile, bond yields are down 18% in that same timeframe. Bond traders are telling us that stock traders are getting ahead of themselves—that the economic recovery won’t be as quick as equity investors think. (Counterpoint: Stock “investors usually discount at least the next two years of macroeconomic performance,” Goldman Sachs told Bloomberg yesterday. So it’s possible the market is already looking past the crisis. But that should apply to bonds as well, and bond yields are still near their lows.)

Source: Bloomberg

That’s not to mention:

-

- stocks are trading at their highest price-earnings multiple (based on estimated S&P 500 earnings) in 18 years

- tens of thousands of businesses won’t survive COVID

- North America has essentially erased all job creation since the great recession in 2009

- a meaningful minority will never get their old jobs back

- post-COVID, indebted consumers won’t spend like they did pre-COVID.

The message for mortgage borrowers and home buyers is twofold:

- Despite the likely spike in real estate activity once home shopping resumes, the recession will work against purchase demand for multiple quarters.

- It’s a pure crap-shoot to lock in a mortgage rate because stocks seem to be foreshadowing re-inflation. Even if 80% of the economy bounces back sooner than expected, it’s that last 20% we have to worry about. It bears repeating: interest rates were already low going into COVID for a reason, and that was when Canada had nearly full employment.

log in

log in

9 Comments

I believe Mr. Butler under estimates the medium and long-term resilience of the GTA real estate market.

Also, the proportion of “must sells” are very likely over represented by the homes that are currently selling. Some home situations are simply untenable, Covid-19 or not.

I very much doubt that there will be any sort of discernible short-term burst in the market, followed by a drop. Pure speculation.

The federal and provincial social-safety net that has been unfurled before us here in Canada is unprecedented and so far quite brilliant. It looks like everyone gets a pony, if they need it.

It’s more than likely that the GTA market will methodically and relentlessly march right back to where it was before. Under-supplied and over- demanded.

Personally I think it’s just common sense that sales will pop once people can do showings again. What happens after that will vary by region.

I would like to leave a remark and look back 3 months from now.

1, the combination of incentives from Fed was held up, will replay after re-open. My personal opinion is that Fed will probably do a big pump of capital injection in housing, and all levels will dance cheerleaders for housing to lead the way back in economy number rush. This might be Fed’s last bet to ease off money printing.

2, if something is going to have shortness of breath, I will say condos have the bigger cloud ahead compared to the detached sector. Foreign owners, visa students tenants, condo air quality, already high in price, Airbnb new rules, etc. will be the triggers.

We will get to see how good Garrett’s predictions were.

https://www.stlouisfed.org/~/media/files/pdfs/community-development/research-reports/pandemic_flu_report.pdf

COVID-19 will be very disruptive to the real estate market. In big markets like Toronto, you’ll see AirBnB hosts offering their apartments for longer-term rentals. On the positive side, this will improve rental affordability. I also predict significant short and long-term disruption in the commercial market. In addition to the obvious short-term impact of some businesses going under, there will be long-term demand destruction in the commercial real estate market as some office workers will decide they want to keep working from home after the pandemic.

The “must sells” are pushing prices lower as we speak. I would wait for the dust to settle before even thinking about buying. Maybe the market does come back strong but it won’t be this year.

Given variable rates are falling, would you suggest and banks starting to offering prime-.15 (2.3%) on a 5 year closed uninsured product – do you feel there is momentum for those discounts to widen over the next couple months? For those of us with renewals coming up in the summer, curious if now is a good time to lock in an early renewal or wait it out in anticipation of bigger discounts off prime to come?

Hi John, Barring some other unexpected market blow-up, bigger variable-rate discounts are coming. For someone looking specifically for a floating rate, I wouldn’t rush to lock into any rate inferior to prime – 0.45%.

Question: I was very interested in RateSpy’s comment (above) that seems to anticipate higher inflation rates ahead as a consequence of government’s loose monetary policy. I’m curious if this means you also anticipate strong demand in the economy…or do you think there can be high rates of inflation in the absence of strong demand?

Hi Barry, Deflation and disinflation are the bigger risks for 2020, albeit some goods (e.g., food) are an exception. Longer term, visibility is too murky to have any firm position on inflation. One can look to the past and note that quantitative easing didn’t trigger hyperinflation after the financial crisis. But with a broken supply chain and unprecedented government relief programs, supply/demand could be imbalanced enough after the economy’s re-opening to spike inflation for a while. That’s not a prediction, just an outside possibility–shared so that readers know all potential outcomes, in case they need to manage mortgage risk more conservatively.