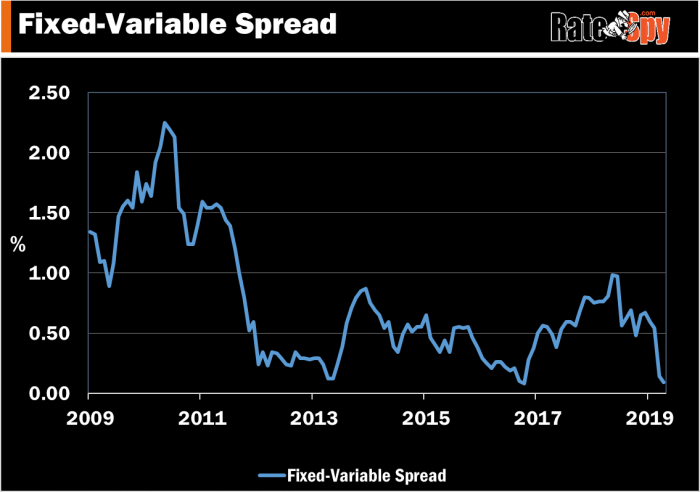

The gap between the best 5-year fixed rates and best variable rates is the smallest its been in two and a half years.

We’re talking less than 1/8th of a percentage point between them.

Depending on the equity a borrower has, folks can even find 5-year fixed rates that are below the best variable rates.

What’s Provoking It

One reason for this oddity is shrinking “term premiums.”

One reason for this oddity is shrinking “term premiums.”

What’s a “term premium?”

It’s essentially the extra compensation (yield) that investors demand for holding bonds longer. And it’s been dropping.

“…The term premium has been falling steadily since 2009 and is currently at or below zero,” said investment firm Neuberger Berman in this recent report.

Reasons for the declining term premium include:

- less concern from investors about inflation volatility

- central bank bond buying (greater demand for bonds results in lower rates, other things equal)

- rate hikes from central banks (when the Fed raises its policy rate, for example, the term premium usually decreases—as reflected in the narrowing spread between 10-year and 1-year treasury bonds)

Coupled with diminished expectations for economic growth, the shrinking term premium has helped invert Canada’s yield curve—i.e., made the 10-year bond yield trade below the Bank of Canada’s overnight rate.

This is largely why 5-year fixed and variable rates are so tight right now.

Esoterica: An inverted yield curve doesn’t technically require a negative term premium. The yield curve can invert primarily because investors expect lower rates in the future. In other words, if the Bank of Canada is hiking but market thinks short-term rates will be lower over the next 10 years, the 10-year bond yield can drop below the overnight rate (as it has at the time this is being written).

Will the Term Premium Rebound Higher?

Eventually, it will.

Eventually, it will.

Neuberger is just the latest Wall Street firm to project a rising term premium. It believes it’s going back to its long-term average thanks to pro-growth U.S. economic policies (which could create inflation risk), falling demand for U.S. bonds and greater bond issuance, among other things. (Remember, most of our rate movement in Canada is influenced by U.S. rate moves.)

Mind you, Neuberger’s isn’t exactly a bold prediction. Financial markets always revert to their mean…someday.

It’s true that the factors Neuberger cites could swell the term premium. And if the term premium grows, the spread (difference) between 5-year fixed and variable rates will likely grow as well.

But that could potentially take a long…long time—anywhere from multiple quarters to several years.

How Borrowers are Playing It

One might think that 5-year fixed rates are overwhelmingly more popular, since:

One might think that 5-year fixed rates are overwhelmingly more popular, since:

A) fixed rates seem relatively cheap compared to variables, and

B) variables are perceived as higher risk.

But, anecdotally speaking, floating rates under 3% are still drawing considerable interest, say brokers and lenders. While we won’t have hard stats on this for weeks, it appears uptake on variables remains strong—despite them selling for almost the same prices as long-term fixed rates.

Many borrowers simply don’t believe that rates will surge in the next five years. All the recent press about yield curve inversion foretelling a recession is fuelling that thinking even more.

Indeed numerous factors could keep term premiums—and rates in general—down. Not the least of which are low inflation expectations, self-fulfilling negative sentiment (e.g., from people who believe the yield curve’s warning signs) and the threat that governments buy more bonds, which keeps rates lower. By the way, the U.S. Fed may have to buy even more bonds than it did before the global financial crisis.

The takeaway here is that there’s a reason why the gap between fixed and variable rates is compressed. And the reason is not that investors expect a booming economy, up-trending inflation and surging interest rates.

log in

log in

5 Comments

Hi Spy,

I started 5-year variable closed with TD (Prime-1.15) in Aug 2018 @ 2.45 that is now 2.95.

Now TD is offering 3-year fixed @ 2.99. Should I switch or keep the variable.

Thanks.

Hi Sekhon,

2.99% is pretty good for a 3-year fixed, but if you shop around you can find that same rate as low as 2.79% with no legal fees, no appraisal fees, a discharge fee rebate and a non-collateral charge (which can often make switching lenders a bit cheaper at renewal).

That’s not to say a 3-year fixed is the right term for you. To make that call an advisor would want to learn more about your tolerance for higher rates in 2022, the chance you may break your mortgage early, your potential need to port and increase the mortgage before maturity, whether you want an opportunity to enjoy lower rates (if rates fall), the other rates/terms that may apply to your circumstances, etc.

Cheers,

Melanie

Melanie McLister

Mortgage Broker

intelliMortgage Inc.

FSCO#: 12326

Hi Melanie,

Thanks for the advice. I do agree with non-collateral charge and everything but switching lenders would trigger a 3-months interest penalty as I am already on a 5-year variable closed with TD.

Regarding the tolerance. I am fine with higher rates in 2022 which I would be going anyways in 2023 if I don’t switch and stay with my variable closed.

I am just thinking if keeping remaining 4 year variable discount is a good option or I should go for a 3 year fixed based on current market situation.

Thanks,

Sekhon

I’m pretty certain that although TD is offering the 2.99% you won’t be able to get it as you’re already their client. Although many lenders advertise that you can convert from a variable to a fixed for free, there is no incentive for them to give you their lowest rate.

Hi Sekhon,

If “based on current market situation” means “based on where rates are headed,” no one can tell you unfortunately.

For what it’s worth, most existing variable-rate borrowers are not locking in these days. That’s partly because

* the market is projecting flat to slightly lower rates

* conversion rates (for existing variable-rate borrowers) are sometimes inflated

* conversion entails effort and indecision

* bonds yield don’t look threatening at the moment: http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=TMBMKCA-05Y&insttype=&freq=&show=

* variable mortgages usually have more flexibility.