—The Happy Canada Day Report: July 1—

- Fixed or Bust: Canada’s lowest nationally available conventional variable rate is just nine basis points cheaper than a comparable 5-year fixed rate. That minuscule “fixed-variable” spread is now 80% narrower than its 10-year average. In other words, the market is no longer compensating new borrowers for the risk of a floating-rate mortgage. And that may be a problem. Why? Because prime rate almost always climbs after a recession — even if only for a few years and even if only a limited amount. If, for example, the BoC hiked a modest 75 basis points like it did in 2010—today’s nine-basis-point variable-rate “advantage” would not be enough. In other words, you’d still pay less in a 5-year fixed. That’s true even if said rate hikes didn’t happen for the next four years. The message for mortgage shoppers: If you plan to ride out your mortgage for five full years with no changes, the math doesn’t look appealing for variables at today’s so-so discounts (from prime rate). Yes, rates could still fall, but it’s impossible to time the bottom, and today’s best fixed rates are just two points from free money.

Spy Tip: If you do opt for a 5-year fixed, pick a fair penalty lender unless you’re quoted an exceptional rate and there’s a low probability of breaking or refinancing the mortgage early. Otherwise, the risk of an interest rate differential penalty simply isn’t worth it.

- RBC Cuts: Big blue lowered a bunch of rates today:

- Special fixed rates:

- 1yr: 2.89% to 2.74%

- 2yr: 2.54% to 2.39%

- 3yr: 2.64% to 2.49%

- 4yr: 2.69% to 2.54%

- 5yr: 2.89% to 2.59%

- 7yr: 3.39% to 3.24%

- Special variable rate:

- 5yr closed: 2.40% to 2.25% (Prime – 0.20%)

- Special fixed rates:

- CIBC Cuts: The imperial bank has dropped two special fixed rates:

- 5yr fixed: 2.82% to 2.57%

- 7yr fixed: 3.07% to 2.99%

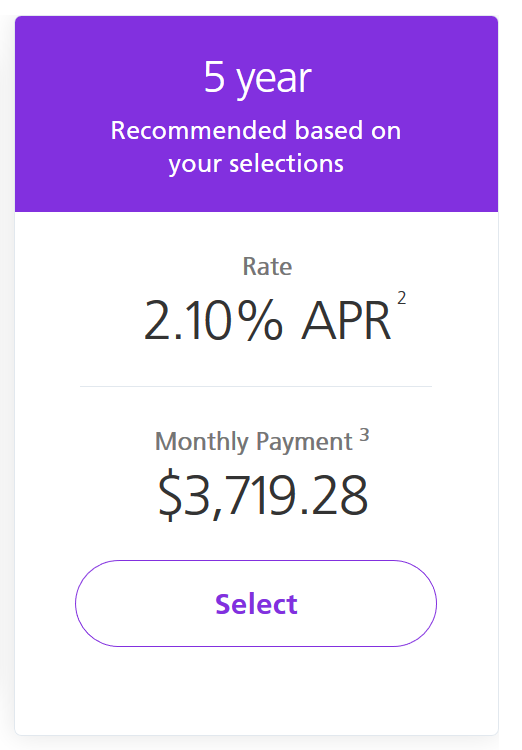

Banks are clearly getting more aggressive with 5-year fixed rates, and it’s about time. The lowest nationally available conventional 5-year rates have been 2.14% or less for weeks. Scotiabank’s eHOME site is quoting spectacular deals: as low as 2.10% for insurable purchases and 2.15% for uninsured purchases—even lower than Scotia offers through its own Home Financing Advisors and brokers.

- Lending Slowdown: Ontario mortgage transactions fell 8.3% year-over-year in May, says Teranet.

- Counterintuitive: “HELOC borrowing…plummeted at the fastest pace in recorded history in April, the last data point available,” says Scotiabank.

- G-D-Plunge: Our economy shrank in April with GDP plummeting a record 11.6%. Believe it or not, that was better than expected. With many investors expecting worse, bond yields were little changed.

log in

log in

58 Comments

Hi Spy,

I had locked in a rate of P-.8% variable which is currently 1.65% (off P=2.45%) for a refinancing 3.5 months ago and my current bank is countering with 2.2% 5yr fixed to renew with them so difference of 0.55%.

I know this article mentions fixed is better but my variable spread was locked almost 4 months ago when it was bigger spread.

Do you recommend I take the 5yr fixed at 2.2% or the variable at 1.65% ?

Hey Chris,

The message here is more intended for new borrowers who have to choose between *current* fixed and variable rates.

For existing borrowers and applicants (like you) who have better discounts, it’s more complicated. Prime – 0.80% is right on the bubble. A good rate but not a great rate.

To say which is best for you would require knowing your credit, employment, risk tolerance, debt ratio, savings, five year plan, etc. But for someone who’s well qualified, has the mindset to handle 100+ bps of rate hikes in 2-3 years, has a financial safety net, and so on, a prime – 0.80% variable can be a reasonable gamble.

Hi Spy,

Just curious, what were the biggest variable discounts given in the recent cycle? I’m at p-1.06 with HSBC.

Hey Mike, Last November a few lucky souls got effective rates of prime – 1.46% (insured only). That’s the lowest we have on record.

Wow. We need to renew our P-0.65 variable soon and the best we’ve been offered is P-0.5 on a new five-year term, or 2.19% on a five-year fixed, in Atlantic Canada, for an insurable mortgage, so that’s a 24-bps spread.

I’ve been pretty much planning to go with variable again, thinking that prime may stay where it is long enough for those 24 bps to work in our favour, but now I’m questioning it. I’m not completely sure we’ll be riding out the full five years, but with a fair-penalty lender breaking the mortgage isn’t as much of a concern. Food for thought!

Hey Brent, There are lots of reasons to take a variable but a 24 bps upfront rate edge is not one of them, not with prime at its effective lower bound.

3 days ago I got 1.89% locked for 5 years. Feeling lucky I guess.

Well done Sher!

What was the lowest variable in the past year for uninsured? We got P-1.11 with HSBC back in March/April.

Will, The lowest nationally-available uninsured variable rate in the past year is today’s 2.05%. You nailed 2020’s biggest uninsured discount from prime at P – 1.11%.

What has the lowest uninsured 5 year fixed rate been in Ontario?

Archer, Do you mean ever?

The whole world is offering 1.99 fixed and this did not even mention that, hello WAKE UP….

[Language edited to comply with site policy.]

Moses, Not quite. 99% of lenders are above 2% on fixed rates. And no lenders are publicly advertising sub-2% uninsured fixed rates (4 in 5 mortgages are uninsured). This site also has a national readership. That’s why we chose the lowest nationally available uninsured rates for the examples.

With respect to insured/insurable mortgages, that’s where you’ll find some sub-2% rates and we’ve written about them many times. But, it’s not the absolute 5-year fixed rate (e.g., 1.99%) that matters. It’s the spread between fixed and variable rates that matters in this context. And with insured mortgages, five-year spreads are similar to uninsured at 10-13 bps. Hence, the risk/reward is the same and the conclusions are unchanged.

Great article, thanks! I often hear that rates are different for a rental/investment property because they are low ratio mortgages. When banks advertise their rates, is it different for investment properties? If yes, what are some of the best rates on an investment property right now.

Hi S. Singh,

Good question. The answer is yes. Most lenders upcharge 10-20+ bps for non-owner occupied rental properties, due to the added risk. We don’t track those rates but you can click “Available for Refinances” in the rate filters and start your research there. Most of the lenders that appear will offer rental financing. You just have to contact them directly to see what their surcharges are.

Just wondering are there any risks of going with not one of the big banks and rather someone smaller like Tangerine as they have a much smaller interest differential? I’ve read that they can create issues at the time of closing, not sure how true is that but would love to get your guys comment on that. Cheers

Hi Nitish, No risks that I can think of. I haven’t seen many competitive rates from Tangerine lately (other than its 2.35% HELOC rate) but Tangerine is very reputable, has great mortgage features and is owned by Scotiabank.

My current variable rate is 1.75% with 6 months remaining. My bank just provided me with a 5 year fixed at 2.44%. What’s your opinion here, wait the 6 months or take the fixed rate?

I have a 5-year fixed Mortgage at BMO from August 2017 at 2.59%. It is one of those Mortgages that yes I have 2.59% but they list the posted rate at the time was 4.84%. Due August 2022. Uninsured with more than 50% equity.

So is the penalty based on the 4.84% rate?

I see the Scotia eHome is 2.15% for the 5-year fixed.

Would my penalty be too large?

Hey Paul, Plug all those numbers in here and it will spit out an estimate of your BMO penalty: https://www.bmo.com/calculators/prepayment/

Then compare the old and new rates here and see if the savings offsets the penalty and switch costs over your remaining term: https://www.ratespy.com/mortgage-rate-comparison-calculator

Hi guys. What do you all think of 1 year and 2 year fixed rates here? The mortgage would be insured. Thanks.

Hey James, At 1.64% to 1.89%, 1yr and 2yr insured rates are excellent alternatives to a variable for most well-qualified borrowers who don’t mind starting the renewal process in 9-21 months. One benefit besides the flexibility of an earlier maturity is the ability to (hopefully) renew into a low-cost variable when deep discounts come back.

I need to refinance in August

Where should I turn too?

I likely will sell within next 2 years or so

I also need to tie my line of credit with it , the mortgage that is,any suggestions?

Hey Linda, There are lots of questions before the answer, like: What do you mean by “tie my line of credit with it?” Are you open to switching lenders? Who are you with now? What province, loan amount and home value? Are you well qualified with stable employment, great credit and a reasonable debt ratio (monthly household obligations less than 40% of provable gross household income)?

I currently have a 5 yr fixed with first line @ 2.69 it is a matrix mortgage which has a borrowing account that goes up in value as I pay down mortgage set at prime +1/2. Now CIBC is taking over and offering a 5 yr fixed at 3.22 or variable at 2.43 , any suggestions on my best move , If I take variable I can switch to fixed at anytime .

Hey Cal, Do you have bad credit, missed payments, a mortgage payment deferral, or something else negative going on? Those are somewhat abysmal rates.

If you’re well qualified and don’t need an automatically readvanceable mortgage, I’d quote HSBC’s rates to CIBC (assuming staying with them is a good idea) and tell them to match or you walk. HSBC has an Equity Power mortgage that is like the Matrix but not automatically readvanceable.

What is the likelihood that the 3 or 5yr fixed rate will fall below 2% in 3 months? Or to ask differently, what would have to happen in our macro economy to allow a rate reach sub-2% level (for uninsured)?

My rental mortgage is coming up for renewal end of Sept, and I’ve been offered fixed @ 2.34% or 2.04% variable. I’m leaning towards waiting it out as bond yield will probably stay low for foreseeable future.

Hey Mister, HSBC could get there this month if it wants to. Most other lenders and brokers are 25-35+ bps away from 1.99% on rental rates. Income property rates are usually at least 10-20 bps higher than owner-occupied. 2.34% isn’t too bad at all if it’s a 5yr fixed rental rate. But to answer your question, a continued surge in COVID cases south of the border and/or a wave of corporate bankruptcies could easily sink U.S. yields, pulling down Canadian yields in the process. It’s almost destiny that Canada’s 5yr bond approaches 0%. Only a question of when. It could be 3 months or less or it could be 3 years+.

The Spy,

I just signed with RBC last week for 2.15% variable 5 year but it took me 5 emails and 2 in-person appointments to get it. Should I continue to check your posts everyday or should I get back to normal life now that the marathon negotiation is over?

Hey Richard, 2.15% is 10 bps above the lowest nationally-advertised variable rate, assuming the property is owner-occupied. That may not matter if your mortgage balance and/or amortization are small, or if you’re under-qualified (e.g., have income, credit or debt ratio problems). If you’ve got a big enough mortgage and desire to apply elsewhere, you can save a bit of money by doing so. Check out shorter fixed terms as well.

I changed lenders and got a 5 yr variable for p-.60 TrueNorth which is 30bps lower that my current lender MCAP offered me. I almost had to go with 2.49 fixed cause that’s what i had agreed to but i think my broker got around it by switch8ng me to variable which I originally wanted anyway. I figure I will see if I can get closer to 2% to lock in in the next year or two.

Hey Candice, True North is a competitive lender run by good people. That said, if your plan is to lock in, I’d strongly suggest confirming what rate they’d lock you in at (e.g., best advertised 5-year fixed rate? Or something higher like a posted rate?). If it’s their best rate, ask where you can monitor these rates. And if portability matters to you, ask about the porting policy also.

Rate spy hope you will be able to reply one by one.

TD in start of March 2020 gave me 2.60% minus 0.77 means 1.83% no knowledge at all about mortgages lol. Its is 5yrs variable closed and I think it’s called uninsured because we paid 24%down in order to save few thousands CMHC fee (guys don’t laugh) 🙂

I didn’t know that we can negotiate rate , broker played here actually because of pandemic situations he scared us that bank may refuse now. Our possession date was March 28.

How to negotiate with Bank now in order to make it below2.60% or increase the discount from 0.77 to 0.95etc ?

What options we have? Can we negotiate in a way to tell them “hey we want to switch to fixed but only if you can offer us 1.90 or say 2.0 And if its possible to ask about existing vairable to reduce “

Hi Sohail, Variable discounts have deteriorated since then. 1.83% is the best you’re going to get from TD right now (or probably any major bank). If a variable is the most suitable term for you, you got a solid deal by today’s standards.

Historically what has the lowest uninsured 5 year fixed rate ever been in Ontario?

Hey Archer, I don’t have history on uninsured handy (would have to query the database) but HSBC’s 2.14% is pretty close to the lowest ever.

My term is up in Aug 2020, I’ve been offered 2.24% fixed 5 yr uninsured (over 1mil purchase price..just, with over 40% equity in the home) all credit scores of three owners are above 840. they came in at 2.44% in May. This was from both TD and Simplii (currently with simplii as my org. term was with PC). Currently with Simplii but TD offers a better HELOC for us (allow for three owners). We still have about a month and a bit before its go time. Should I keep holding out for a lower rate? I’m hoping to get a fixed at 2.10% or less. realistic or dreaming?

Hey AWhy, 2.10% may be a stretch but you never know. Keel a close eye on bond yields: https://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=TMBMKCA-05Y&insttype=&freq=&show=

And remember, you need to allow at least 30 days to close if you switch lenders. The lowest published readvanceable 5yr rate that I know of is 2.29% with HSBC and brokers, so you can use that as leverage, or call HSBC or a broker and see if they can help. Good luck….

Thanks for the great article. My situation is a bit different and I need help. I need a mortgage for a new house that I bought in Ontario but I have a plan in my mind to sell it in 1 or max 2 years. Can you please guide me what would he the best course of action for me? Any comment on the penalty of breaking the Mortgage would be great. Thanks.

Hey Ron, I don’t know much about your situation so it’s hard to comment, but if I knew I were going to sell in two years or less, I’d do a 1- or 2-year fixed. No sense paying a big penalty (potentially) on a longer fixed term.

Have a renewal due in next two weeks.

Renewal rates I have been offered From one of the big banks is

5yr fixed closed: 2.20%

5yr VRM P-.47

Not sure which to take.

Mortgage is uninsured, and I have a very good credit rating. Still have a ways to go to pay it off.

Missed all the great rates back in March but need to figure out if fixed or VRM is the way to go and if there are better opportunities.

DM – I’m in a similar situation. Looking at both the VRM and 5 Year fixed from a big bank with similar qualifications as you.

On one hand I’m tempted by the 3 month penalty should we decide to break the variable vs. the 5 year IRD. Yet, the spread between 5 year VAR and FIXED are negligible that it may make more sense to lock in. Big banks don’t seem to offer special pricing on 2 year fixed terms, only 5 year…

Hi Dave & DM, An alternative, if suitable given your circumstances, is a one or two-year fixed (near or below 2%) at a non-big bank.

Hi, my mortgage with TD is ending Aug 1st. I was just quoted 2.34% 5 yr fixed and 2.09 5 yr Var by my TD branch…reading the conversation here these rates seem high. We have well over 50% (probably 75%) equity and I like to make additional payments as I can……any advice on what my rates should be? Should I reach out to HSBC….? Seems they have very competitive rates.

Hi Mark, Those TD rates are pretty typical these days, and somewhat competitive. Plug your numbers in here to see how much you’d have to save on the rate to make a switch worthwhile: https://www.ratespy.com/mortgage-rate-comparison-calculator

Hey Spy,

I have 5yr fixed %3.04 HELOC locked 2019 Jul from CIBC.

Penalty to cancel today is 14K.

There are plenty of low rates around.

Do you think I should cancel it and try to get 5yr fixed like %1.99 ?

Hi Mesutto, It depends on your mortgage amount, among other things. Plug your numbers in here to check: https://www.ratespy.com/mortgage-rate-comparison-calculator

Assume a 4-year term since that’s roughly what you have remaining.

Note, if you have cash lying around you can make a prepayment to lower that penalty a bit. (Consult CIBC to find out how far in advance you have to make the prepayment for it to be credited for penalty purposes.)

FYI….

Buying a condo, excellent credit rating and other assets. Looking for 80%, 5Y fixed, 20/20 & equity build becomes LOC (not sure of rate on LOC).

Had two banks working for my business. CIBC had me approved @ 2.14 and was still ‘trying’ to get it lower. Finally went with BMO @ 2.09 with waived fees as the closing is nearing and did not want to leave this open any longer.

Hey KSO, Thanks for posting. That’s a tremendous offer for a fully readvanceable mortgage + LOC with no fees. Excellent negotiating.

P.S. Tangerine lead the market at prime – 0.10% for its LOC rate. If you can get BMO anywhere near prime or prime + 0.25% you’re doing well.

Hello there. My mortgage is coming for renewal at the end of the month and I have been shopping around. Wondering if you can provide an advice on what to go with.

5-year variable offer @ 1.8% or 5-year fixed @ 1.99%

More than 50% of equity in the house, good credit. Thx.

Hi Iva, This is always a tough question to answer in a message board. Term selection is a personal decision hinging on your assets, income, debts, 5-year plan, risk tolerance, etc. For more insights have a peek at our story this weekend and at this –> https://www.ratespy.com/fixed-or-variable-rate-the-decision-checklist-02223752

Good luck!

Hey Spy,

I am seeing all of these insured rates for 40 BPS below uninsured rates (i.e. butler mortgage rate, where the max you can have down is 19.99%)… Taking a look at a 675K mortgage to get be below the 20% threshold vs the 600K mortgage I was planning on taking, it appears that over 5 years even with the higher payment (variance coming out of the additional 75K + paying for the insurance cost I would have 40-50K in free money based on the insurance savings)…. Am I missing something here, or would it make sense to put down sub 20% and capitalize on the lower insured rated…

Hey Cole, It depends on a few things, not the least of which is the return you’d earn on the money you’re not putting down. For example, consider someone buying a $750,000 home and deciding between the minimum 6.66% down payment vs. 20% down. That person might need a roughly 8% annual compound after-tax return on the $100,000 they don’t put down, in order to justify making the minimum down payment and paying the insurance premium. If you have a really good use for your cash, I’d suggest having a good broker or financial planner run the numbers for you. For most people, it usually makes more sense just to put down the 20%.

I am also shopping around for mortgage renewal. BMO offered me 1.7% 5-year variable, and 1.9% 5-year fixed. I want to take the 5-year for peace of mind. The only issue I have is regarding the prepayment penalty as I would like to keep the option open to sell my house and break the mortgage. But I am thinking with the 1.9% fixed rate, BMO’s current 5 year fixed posted rate of 4.79%, the prepayment interest will always be 3 months only, as the Discounted IRD rate (1.9% current contract rate-future posted rate of X +2.89% discounted rate obtained) will be unlikely positive (which means the posted fixed rate has to be lower to 2.89% in the future to be bigger than the 3 [email protected]%). My conclusion, the variable and fixed spread is so minimal, and the prepayment penalty in the current scenario makes no difference, and I bet the future prime rate will definitely rise, we should go with fixed rate. Could someone please validate my logic?

Hi Mandie, If there’s a reasonable probability you’ll break the mortgage early, I’d steer clear of a Big 6 five-year fixed unless there were a really compelling reason to go that route. Such reasons, for example, might include materially lower total borrowing costs (considering the upfront rate versus alternatives, fees, penalties and any cash rebates), value-added features (like a competitively priced readvanceable credit line, BMO’s Cash Account etc.), and so on.

The thing about Big 6 penalties is that IRD usually kicks in even if rates go sideways for years before you break the mortgage. You can confirm that by simulating different scenarios using BMO’s penalty calculator: https://www.bmo.com/calculators/prepayment/

Hey Spy,

First off thanks so much for replying, 2nd I apologize in advance for the length of my reply… I understand what you are saying, in terms of the use of funds and in this market a 8% return is far from a certainty, which is why originally, my intention was to put down 25-30%. Allow me to outline a few numbers to explain a bit more detail which is causing me to rethink that, now, I could be completely off on this (which is why I am asking you I suppose). It appears to me when looking at the rates on your page the lower rates only appear to be available for mortgages that are putting down less than 20%… With that, the mortgage payment itself is less (or marginally more) for borrowing more. Now, perhaps I am misreading this and these lower rate’s are not in fact only available when putting down sub 20% ( i.e. butler mortgage appears to be only Permitted Loan-to-Value 80.01% to 95%) offered at 1.6% ( over 20-years for a $650K mortgage the payment is $3,165) where HSBC which has a Permitted Loan-to-Value of up to 80% (over 20 years for a $600K mortgage the payment is $3,022). In this scenario, it will take 349 months of paying the $143 more a month ( or 29 years ). Over the life of the loan the total interest paid on a 600K mortgage at 1.96% is $125,747 vs the $650K mortgage at 1.6% is $109,967). Granted all of this does not include the cost of insurance, but I just wanted to get your thoughts on at what point the lower rate with less down outweighs the higher rate with 20+ down.

Thank you so much!!!

I just realized the logic flaw in my statement as I was only considering the interest rate 1.9% vs the IRD rate being smaller than the 1.9%. I forgot that the IRD rate is going to be applied on the remaining terms of the mortgage, versus the 3 [email protected]%. Also, depending on the timing to break the contract, the 4 year, 3 year, 2 year or 1 year posted rate will be lower -0.5 so the IRD rate will be increasing as the time lapses. Conclusion: nah, nah, the fixed rate mortgage prepayment penalty will always be higher than the variable