—The Mortgage Report: Weekend Edition—

Canada’s rate outlook got a boost this week from two influential developments:

- Promising vaccine news (20 potential vaccines are in late-stage trials, including Pfizer’s drug that’s reportedly over 90% effective), and

- The widespread acceptance of Joe Biden’s presidential victory.

This much-needed dose of good news led investors to sell government bonds, which is typical when the economic outlook brightens. And when bonds go down, rates go up.

Canada’s 5-year yield ended the week 0.06 percentage points (6 bps) higher at 0.46%. If yields climb another 10-15 bps, the most competitive lenders will almost certainly take fixed rates up a notch.

Side note: As we speak, the “5-year fixed rate – 5-year swap rate” spread is under 100 bps for the first time in two years (based on estimated discretionary rates at the Big 6 banks). That means banks have started selling 5-year fixed mortgages at compressed profit margins. They’ll be itching to recover some profitability if rates climb much more.

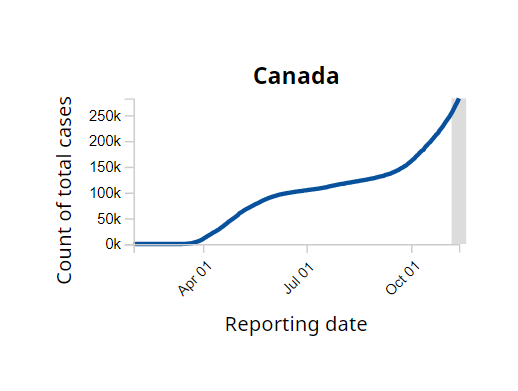

Either way, while hope is on the horizon, the horizon is far. And there’s lots of rough water ahead from record COVID cases, hospital beds filling up and calls for new lockdowns. Those and other headwinds could limit the ascent of yields (and fixed mortgage rates) in the coming weeks. By how much, no one can say.

This bear vs. bull (bad news vs. good news) battle is something we’ll have to get used to before vaccines, antivirals and other treatments give people enough confidence to go out, spend more money and drive inflation again.

That’s why the economy might not regain its footing until well into 2021, some say. Although, even that is more optimistic than central bank forecasts.

Prior to this week, the BoC in its MPR didn’t expect vaccines to be widely available until “mid-2022.” Trudeau now says one might launch as early as Q1.

If first-quarter vaccinations lead to meaningfully fewer COVID cases, “I would expect the Fed to start thinking about changing their 2023 outlook to 2022 or maybe even the last half of 2021 to start raising rates,” Andrew Brenner, head of international fixed income at NatAlliance, told Reuters. And where the Fed goes, the BoC usually follows.

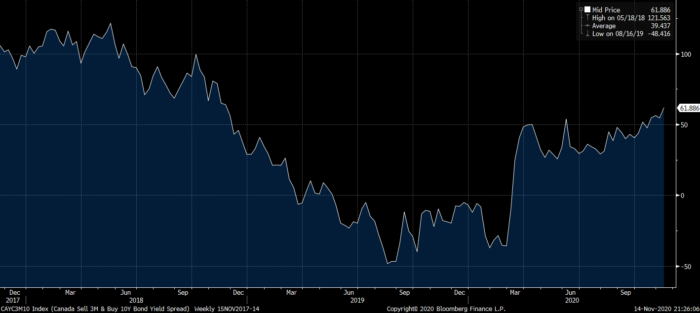

Meanwhile, the gap between 10-year yields and 3-month yields is near the biggest it’s been in two years. Traders refer to that gap as the “slope” of the yield curve. When the slope steepens (i.e., the gap widens) after a recession, it generally reflects greater expectations of inflation down the road, and ultimately rate increases.

All this is to say, there’s a good chance rates won’t be this low by the end of next year.

Between now and then, however, rates will take numerous zigs and zags — fuelled largely by U.S. fiscal policy, income support from Ottawa, hospital utilization rates, public restrictions and the vaccine outlook.

Unemployment & Housing De-correlated in 2020

- High unemployment has historically been kryptonite for home prices. Yet, “The three cities reporting the highest increase in mortgage debt levels also reported higher-than-average declines in employment growth,” writes Haider & Morranis. Not all employment is created equal, of course. This recession was unique in that those out of work have a much lower probability of being home buyers in the first place.

Mortgage Myths

- A new survey from sister site RATESDOTCA shows that mortgage misconceptions abound. Among them:

- 4 in 10 say they have at least some ability to predict mortgage rates five years in the future

- 6 in 10 didn’t know that variable rates have outperformed fixed rates

- 6 in 10 think it’s best to use a cash windfall to prepay their mortgage

- 1 in 3 think they can avoid default insurance by putting down just 10% or less

- We analyze these and other mortgage myths here.

Grandfathering Tip

- Mortgagors sometimes try to switch lenders for a better rate, only to find they can’t pass the mortgage stress test.

- But, if they closed their original mortgage before November 30, 2016, there’s a loophole. There are lenders who will exempt insured/insurable borrowers from the federal stress test, so long as they can afford a payment based on their actual 5-year fixed rate (as opposed to the minimum stress test rate, which is currently 4.79%).

- Next year will be the last year that most borrowers can take advantage of this.

- Note: This “back door” lets you get the best available rates but it only applies to switches (not purchases or refinances).

- There is a different loophole through certain credit unions, however. It lets borrowers qualify at the contract rate for purchases and refinances too, but the interest rates are up to a point higher in some cases.

Quotable

- “Credit is flowing…practically normally.”

—BoC Senior Deputy Governor Carolyn Wilkins at a speech to the Munk School of Global Affairs and Public Policy.

log in

log in

5 Comments

On your point about stress test grandfathering, are you suggesting that B20 allows grandfathering – not aware of that. So this must be for non federal and presumably reflects grandfathering on portfolio insurance for loans made before the changes to the insured rules in 2016. I assume that grandfathering was done on purpose by government given that the brokers and others suggested the sky would fall as a result of those changes. Of course time has proven that those changes had little impact (other than improving the quality of lending overall) – anybody having trouble getting refinanced at all time lowest rates? Didn’t think so. Credit has never been more available and rates have never been lower – ever.

David, It applies to insured/insurable mortgage switches. The 2016 policy changes were not intended to trap people at their lenders if they qualified under the old rules. Grandfathering addresses that.

As for the stress test impact, the jury is out on:

* how many people the stress test forced into renting

* how many people missed out on equity appreciation as a result

* how many people could not refinance and were stuck paying higher rates on existing debt for no reason

* how many people had to refinance into a new mortgage with much higher rates and worse terms.

Policymakers don’t predict interest rates. The fact that rates fell *after* a policy is implemented (thus helping refinancers) does not make it good policy — unless you think extraordinary rate declines were foreseeable in 2016 and rates will never go back up.

The point is, we would not be in such a rush to conclude the impact has been (and will continue to be) “little.”

Before covid, B20 was also doing a great job of making renting way more expensive.

The government is a one trick pony. Great at killing demand and useless at creating supply. Unless you’re on welfare.

That’s why their brilliant B20 did nothing to slow all the ridiculous price gains. Every single housing policy person in Ottawa should be fired unless they are working on supply solutions for the common man.

Hey GregH, While I might phrase things a bit differently, there’s an element of truth there. So far, federal housing policy (including but not limitted to the National Housing Strategy) has been a dud with respect to creation of middle-class housing supply.