Not much going on this weekend. Only a little meeting between the world’s two most powerful leaders about 2019’s single most important economic issue.

U.S. prez Trump and Chinese supreme head communist guy, Xi, collide over trade ahead of Saturday’s G-20 summit in Japan. And, batten down the hatches, because it has the potential to be a short-term tide changer for mortgage rates.

Also fuelling a sentiment change is crude oil, which is up near 4-week highs. That’s sometimes a slightly bullish sign for fixed rates near-term.

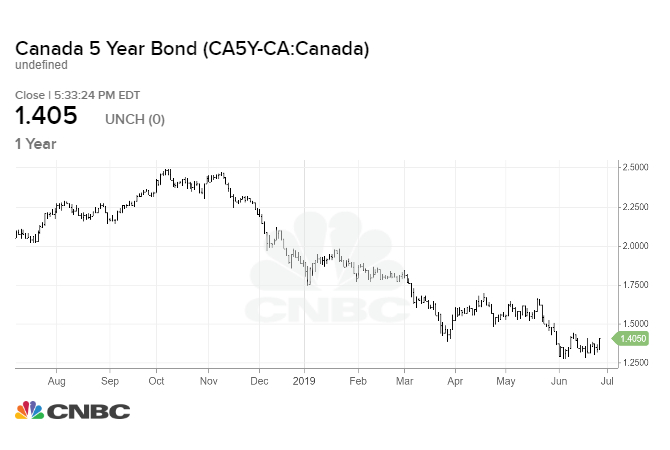

Meanwhile, bond yields—which guide fixed mortgage rates—are trying their best to put in a short-term bottom.

The moral of the story: If you’re mortgage shopping and waiting to lock in until fixed rates drop more, be careful. There’s a legit risk that rates pop higher before making new lows. Trump wants to come away with good news and play the trade hero. Markets are coiled up just waiting to explode (i.e., bond yields higher) if a China breakthrough appears likely.

Can’t Be Greedy

If you’re closing in the next 120 days and leaning fixed, get a rate hold by next week, especially if G-20 news out of Japan is positive this weekend.

5-year fixed rates are now as low as 2.42% (for insured mortgages) to 2.79% (for refis). That’s crazytown for an economy with above-target inflation and record-low unemployment.

If the most competitive lenders do offer more 5-fixed discounts, they probably won’t be headline-making. That is, unless the orange-haired wonder can’t make nice with China and goes on a tariff rampage.

Weekly Steals

Here are this week’s best-in-class rate deals…

Fixed

- 1.99% 2-year fixed at DUCA (Ontario / insured only)

- 2.42% to 2.49% 5-year fixed at online brokers (AB, BC, NB, NL, ON, PE / insured only)

- 2.63% to 2.69% 5-year fixed at online brokers and HSBC (uninsured / refis okay)

- 2.94% to 2.99% 10-year fixed at online brokers and HSBC (nationwide / insured only)

Variable / Other

- 2.59% 1-year fixed at Butler Mortgage (AB, BC, ON / no loan-to-value restrictions)

- 2.61% to 2.65% variable at online brokers (insured only)

- 2.69% 5-year hybrid mortgage rate / half-fixed half-variable (Ontario only)

- 3.75% HELOC at motusbank

log in

log in

The moral of the story: If you’re mortgage shopping and waiting to lock in until fixed rates drop more, be careful. There’s a legit risk that rates pop higher before making new lows. Trump wants to come away with good news and play the trade hero. Markets are coiled up just waiting to explode (i.e., bond yields higher) if a China breakthrough appears likely.

The moral of the story: If you’re mortgage shopping and waiting to lock in until fixed rates drop more, be careful. There’s a legit risk that rates pop higher before making new lows. Trump wants to come away with good news and play the trade hero. Markets are coiled up just waiting to explode (i.e., bond yields higher) if a China breakthrough appears likely.

4 Comments

Hi Spy,

I’m torn between a 1 year fixed and variable. Any thoughts?

Thanks

Hi MarkJ

Assuming a 1-year or variable are suitable to a borrower, here are some of the…

Pros of a 1-year:

* Lower up-front rate on most conventional mortgages

* Can reset to a lower rate in 12 months (meaningful if rates fall by then; a 25-50% probability if one believes the market)

* More flexible if you expect a life change in 12 months (e.g., a move or sale or need for more cash)

Cons of a 1-year:

* Must refinance/renew in 12 months (with $300-$1000 of costs if you must switch lenders for a better deal)

* There’s always a risk that overall market rates fall or stay flat in 12 months, but mortgage discounts shrink in 12 months

P.S. In the off chance you’re buying with an insured mortgage in Ontario, DUCA’s 1.99% almost can’t be beat.

The only thing we can expect from this weekend is that something unexpected will happen.

Looks like US yields will open higher on Monday.

https://www.bloomberg.com/news/articles/2019-06-30/fed-cut-bets-won-t-vanish-just-because-trump-and-xi-played-nice