People are constantly hoping to time the rate market, despite how ineffective it may be.

People are constantly hoping to time the rate market, despite how ineffective it may be.

For the brave souls who try, here’s some interesting research from the U.S. Federal Reserve.

One of its economists, Claudia Sahm, has documented a pattern in unemployment data. In her Fed report, she writes, “…Comparing the three-month average [U.S.] unemployment rate to its low over the prior 12 months—signals a recession well before the official dating of a recession.”

“Early in each recession since 1970, the unemployment rate rose at least 0.50 percentage points,” she adds.

That makes sense, of course. As the economy slows, people lose jobs.

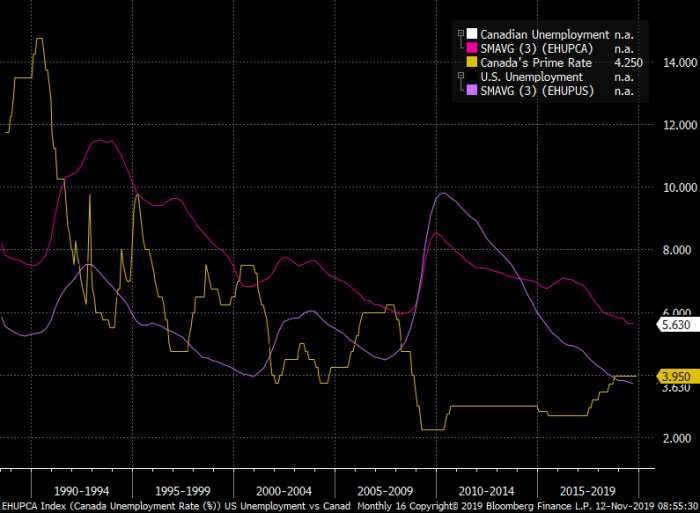

If you glance at a chart, this early warning signal appears to work on Canadian rates too. In fact, given how economically tied the U.S. and Canada are, upturns in American and/or Canadian unemployment tend to portend Canadian rate cuts.

The following graph, which plots three-month averages of U.S. and Canadian unemployment rates against Canada’s prime rate, illustrates that relationship.

Chart source: Bloomberg

What It Means

On the face of it, a change in direction of the U.S. or Canadian three-month moving average of unemployment usually coincides with a change in direction of prime rate (they move inversely).

Using such a strategy, one could theoretically:

- choose a short-term mortgage rate when U.S. and/or Canadian unemployment changed direction and started rising

- choose a longer-term mortgage rate when U.S. and/or Canadian unemployment changed direction and started falling.

As promising as this strategy might look, however, relying on indicators like this to pick a mortgage term can be hazardous on a good day.

As promising as this strategy might look, however, relying on indicators like this to pick a mortgage term can be hazardous on a good day.

For one thing, there’s not enough data to back-test the system’s reliability. That creates the risk of false positives.

Because of this room for error, the prudent way to choose between fixed or variable is the same as it always was. Common decision factors include the:

- Historical edge of variable and short-term rates

- Borrower’s tolerance for higher interest costs

- Borrower’s psychology with respect to rate volatility

- Borrower’s financial means

- Borrower’s creditworthiness

- Difference between fixed and variable rates.

All that said, for financially sound borrowers looking for a tie-breaker to decide between fixed and variable, the unemployment indicator is worth watching. The Spy will continue reporting on any significant shifts in direction with this signal, if and when they happen.

log in

log in

2 Comments

Just wondering. What are the main leading indicators for unemployment? Thanks

Hi couchinvestor81,

They’re quite imperfect but some examples include capacity utilization, the Institute for Supply Management indices, the consumer expectations gap (i.e., difference between current sentiment and expectations) and business hiring intentions.