By The Spy on

February 18, 2021

A scattering of lenders are starting to warn of impending rate increases. No surprise—given Canada’s 5-year bond yield, which drives fixed mortgage rates, hit a new relative high on Thursday. At 0.60%, it’s now the highest it’s been since April 9, 2020. When the 5-year yield was last at these levels, your typical discretionary 5-year fixed rate at a Big...

read more

By The Spy on

February 16, 2021

The entire mortgage market was waiting, and now, after 10 months, it finally happened. Canada’s 5-year bond yield (which influences fixed mortgage rates) broke through major resistance, resistance that goes all the way back to April of last year. It’s a signal that better economic times lie ahead. A sign that inflation should no longer be just an afterthought. A...

read more

By The Spy on

February 10, 2021

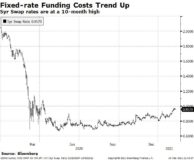

It’s not getting any cheaper for banks to fund a fixed-rate mortgage. In fact, Canada’s 5-year swap rate, a common measure of 5-year funding costs at the big banks, is running at a 10-month high. Yet, still we’re seeing lenders trim 5-year fixed rates as the cut-throat spring market approaches. RBC chopped its 5-year fixed by 18 bps last week....

read more

By The Spy on

January 20, 2021

In Brief Today’s Announcement:No change to rates Overnight rate:0.25% Prime Rate:2.45% (also no change; seePrime Rate) Market Rate Forecast:No BoC hikes until late 2022 BoC’s Headline Quote: “The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2% inflation target is sustainably achieved. In our projection, this does...

read more

By The Spy on

January 19, 2021

If you’ve got a hankering for a mortgage with maximum rate assurance, none beats the 10-year fixed. But once Canada rounds the corner on its economic recovery, 10-year rates could climb faster than other mortgage rates. The reason: 10-year terms reflect longer-term economic expectations than 5-year terms, for example. As a result, they often react more to changes in the...

read more

By The Spy on

January 14, 2021

Variable rates on new mortgages could get a little cheaper this quarter, for one of four reasons, or maybe all four: Bankers’ acceptance (BA) rates — a general proxy for variable-rate funding costs — are at an all-time low. That’s boosted the spread between prime rate and BAs to almost a 12-year high. Think of that spread as a rough...

read more

By The Spy on

January 6, 2021

The Mortgage Report: Jan. 6, 2021 U.S. 5-year yields leaped to a 7-week high on Wednesday as Democrats took control of all three houses of government, thanks to their historic win in Georgia. Canada’s 5-year yield rose in sympathy by a less notable 2 bps, but economists nonetheless expect more of an incline in rates this year. The reason: Democrats...

read more

By The Spy on

January 4, 2021

The Mortgage Report: Jan. 4, 2021 2020 was a year that took pleasure in humiliating forecasters. From the remarkable bounce in housing, to the resilience of mortgage volumes, to the devastation in big-city rental markets, to the homeowner exodus from urban cores to the lows of contract mortgage rates, to the persistence of high qualifying rates — 2020 made the...

read more

By The Spy on

December 9, 2020

Quick Rundown Today’s Announcement:No change to rates Overnight rate:0.25% Prime Rate:2.45% (also no change; seePrime Rate) Market Rate Forecast:No BoC hikes until at least 2023 BoC’s Headline Quote: “The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2% inflation target is sustainably achieved.” BoC on the Economy:...

read more

By The Spy on

November 30, 2020

—The Mortgage Report: Nov. 30— Trudeau’s government said Monday that it plans to lift Canada’s debt ceiling by up to 57% as it embarks on record spending and deficits in the name of pandemic relief. Canada’s historic deficit just keeps on climbing. It’s now estimated at $381.6 billion for the current fiscal year, up from $343.2 billion this summer and...

read more

log in

log in