By The Spy on

September 4, 2019

Markets predicted the Bank of Canada would do nothing to rates for the 11th straight month…and they were right. Here’s a quick look at the BoC’s rate statement: Rate Decision:No change Overnight rate: Remains at1.75% Prime Rate: Remains at 3.95% Market Rate Forecast:No change to prime through 2020 BoC’s Headline Quote: “…Canada’s economy is operating close to potential and inflation...

read more

By The Spy on

July 31, 2019

Canadian mortgage rates take their cues from many things, and U.S. monetary policy is near the top of the list. That’s why today’s Fed rate cut—the first since the financial crisis—is meaningful to borrowers. Fed decisions always move Canadian rates in some respect but in this case, key questions remain. Here are the two biggest ones. How Many Cuts Are...

read more

By The Spy on

July 28, 2019

If market expectations are on the money, the U.S. Federal Reserve will drop its key policy rate on Wednesday — for the first time in over a decade. Unlike most cuts, however, this one’s arguably not as urgent. It’s more akin to preventative medicine that wards off (economic) illness before the symptoms get severe. Here’s a quick read on how...

read more

By The Spy on

July 18, 2019

The most important rate in the mortgage industry has dropped. Better late than never. The benchmark posted 5-year fixed rate has fallen from 5.34% to 5.19%. It’s the firstchange since May 9, 2018. And it’s the first decrease since Sept. 7, 2016, despite a 106-basis-point nosedive in Canada’s 5-year bond rate since November 8. Why it Matters The benchmark rate...

read more

By The Spy on

July 10, 2019

Canada’s rate czars stunned no one this morning. Theyleft the country’s most important rate unchanged. Here’s a quick look at the BoC’s statement: Rate Decision:No change Overnight rate: Remains at1.75% Prime Rate: Remains at 3.95% Market Rate Forecast:No change to prime through 2020 BoC’s Headline Quote: “…the Canadian economy is returning to potential growth. However, the outlook is clouded by...

read more

By The Spy on

May 29, 2019

Last meeting, the Bank of Canada finally shifted its rate outlook to neutral. After today’s meeting, the gear shifter is still firmly there. Here’s a quick glance at what the BoC did today: Rate Decision:No change Overnight rate:1.75% Prime Rate: Prime rate remains at 3.95% Market Rate Forecast:Likely one rate cut by the end of 2020 BoC’s Headline Quote: “…the...

read more

By The Spy on

May 18, 2019

This weekend, HSBC seemingly sweetened its 10-year fixed offer even more. It dropped the rate on its website for insured mortgages from the 2.99% announced in its press release Friday to 2.94%. It turns out that was a IT issue. “When they launched the rates, the rate were incorrect on the website,” a spokesperson said. “We have since corrected the...

read more

By The Spy on

May 6, 2019

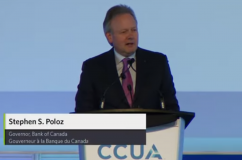

Three-decade-long mortgages are a mainstay in the U.S. mortgage market. But in Canada, 5-year fixed terms dominate the landscape.Forty-five per cent of mortgagors chose them last year, says the Bank of Canada. BoC chief Stephen Poloz wants to see that change. In what he termed a “call to arms,” he challenged the mortgage industry to think outside the five-year fixed....

read more

By The Spy on

May 2, 2019

It’s remarkable how much people focus on the Bank of Canada’s “neutral rate” nowadays. It has become a lighthouse in the rate fog. People rely on it to gauge how far we are from “normal” interest rates. If you’re not familiar with the “neutral rate,” it’s basically the theoretical overnight rate that neither accelerates nor slows the economy and inflation.Last...

read more

By The Spy on

April 29, 2019

Just failed the mortgage stress test and feeling down? Have no fear, a bigger down payment will get you to the mortgage promised land. By putting down more, you’ll lower your debt ratio and be passing the stress test before you know it…as long as you don’t expect a mortgage before 2031. That’s how long stress test flunkies would have...

read more

log in

log in