By The Spy on

July 1, 2019

Back in 2016 some poor souls were getting variable-rate mortgages with unsavoury discounts. We’re talking prime – 0.50% or worse in some cases. That compares to prime – 1.00% or better today. If you’re in this boat, you need to do some math because breaking your mortgage early may be your best option. Here’s a simple example. Assume you’ve got...

read more

By The Spy on

May 30, 2019

Imagine spending hours of your life to: research the best mortgage negotiate for a better rate apply to refinance at a new lender answer all the new lender’s questions collect all your documents get an appraisal review all the paperwork submit all the documents find a lawyer to close the mortgage get ready to close …then be told just five...

read more

By The Spy on

May 8, 2019

You’ve probably never thought about not paying the principal on your mortgage. It sounds almost un-Canadian. But it’s a crazy-sounding idea that, in limited cases, is not so crazy. Out of thousands of home loans in Canada, only two products let you pay just the interest each month: A Home Equity Line of Credit (HELOC) An interest-only mortgage (I/O). HELOCs...

read more

By The Spy on

April 10, 2019

The most competitive online mortgage brokers are just itching to give you a better rate. But many lenders won’t let them. Most broker lenders have what’s called “rate buydown limits.” In other words, the lender limits how much a mortgage broker can reduce your interest rate by giving up some of their commission. Here’s a simple example. Suppose a lender...

read more

By The Spy on

April 8, 2019

In Canada, the cheapest mortgage rates are usually available on insured (or insurable) mortgages. But refinances cannot be insured thanks to rule changes in 2016. That’s been a problem for folks with existing mortgages—particularly those who have “collateral charges.” Collateral charges are mortgages that readvance or have a line of credit attached to them. Examples include the: RBC Homeline Scotiabank...

read more

By The Spy on

March 24, 2019

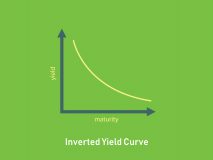

The Canadian yield curve has officially inverted and that’s bearish for mortgage rates. An “inverted yield curve” (in this context) means that the interest rate on almost every Canadian government bond is now below the Bank of Canada’s 1.75% overnight rate. That’s pretty rare. Why it Matters Inverted yield curves are a danger sign. In a normal economy investors like...

read more

By The Spy on

March 14, 2019

Some big banks want to buy your mortgage business, literally, with cash. HSBC, CIBC and BMO are all “giving away” money. Here’s a quick run-down of their offers: HSBC Cash offer: $1,000 for $200,000 to $499,999.99 mortgages $2,000 for $500,000+ mortgages Available on all 5-year closed terms CIBC Cash offer: $1,000 for $100,000 to $299,999.99 mortgages $1,200 for $300,000 to...

read more

By The Spy on

March 5, 2019

The number of Canadians who blindly trust mortgage rate comparison websites is staggering. This year, almost two million households will renew or take out a new mortgage. Of these, CMHC found that over 78% who research mortgages online compare interest rates. The majority of these folks, those who visit a rate comparison website, are simply not being shownthe market’s best...

read more

By The Spy on

November 26, 2018

So many young people want to build home equity and get out from under their landlord’s thumb. But they can’t. They don’t have the down payment to qualify for a mortgage. For many modest-income Canadians, saving up the 5 percent minimum down payment (or 20 percent if you want to avoid CMHC insurance) can take years—many, many years. While some...

read more

By The Spy on

November 22, 2018

Many don’t realize that there are two flavours of floating-rate mortgages: The adjustable-rate mortgage (ARM) Its payment rises and falls with prime rate The variable-rate mortgage (VRM) Its payment doesn’t change when prime rate changes The only exception is when rates soar so much that you’re not paying all the interest. Then the payment generally rises to cover the interest...

read more

log in

log in