By The Spy on

August 16, 2015

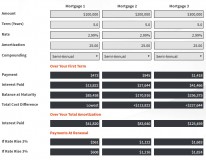

It’s often helpful to know how much extra interest you’ll pay with a higher rate, a bigger mortgage, shorter compounding and/or a longer amortization. Now, the Spy makes that easy with anall-new monthly payment calculator. This tool lets you: Compare three different mortgages Instantly find the lowest cost option View interest cost over the term and amortization Check yourbalance at...

read more

By The Spy on

July 14, 2015

You really should lock in your mortgage. Rates are historically low and they have to go up…eventually. Sound familiar? It may well be one of the costliest fallacies in today’s mortgage market. It’s kind of like saying stocks have to fall because the market is already up 200%. Or home prices must drop because they’re up 80% in just a...

read more

By The Spy on

July 4, 2015

The chart below shows the average best rates for each mortgage term on RateSpy.com. It provides a good sense of rate premium you’ll pay for the security of a fixed rate and/or longer term. Trendsfrom the last 30 days The 5-year fixedis the most-chosenterm in Canada. Its uptake is slowly declining, however, as more Canadians anticipate that low rates will...

read more

By The Spy on

June 28, 2015

The mortgage market is a bit like Baskin Robbins. The flavour of the month canchange. Take the popularity of variable rates, for example.“The proportion of new mortgages being advanced at variable rates hasincreased over the past several years and has reached about 32% (in April 2015),” says the Bank of Canada (BoC). Compare that to all outstanding mortgages, in which...

read more

By The Spy on

June 14, 2015

The nation’s fifth-largest bank has just rolled out two juicy newrate specials: A 1.99% one-year fixed A 2.99% seven-year fixed Both rates are the lowestin the country for theirrespectiveterms, and the lowest in recent memoryfor a major bank. But one is far more enticing than the other—that is, CIBC’s newone-year promo. At 1.99%, it undercuts mostheavily discounted variable rates. Moreover,the...

read more

By The Spy on

June 7, 2015

The chart below shows the average best rates for each mortgage term on RateSpy.com. This graph provides a sense of how much of a rate premium you’ll pay for the security of a longer-term and/or fixed rate. Key Takeaways from the last 30 days The most popular term in Canada is still (no surprise) the 5-year fixed. Those rates start...

read more

By The Spy on

May 8, 2015

The chart below shows the average best rates for each mortgage term on RateSpy.com. This graph provides a sense of how much of a rate premium you’ll pay for the security of a longer-term and/or fixed rate. Key Takeaways The difference (spread) between 5-year fixed and variable rates has shrunk in recent weeks to roughly0.39percentage points. That’s far less than...

read more

By The Spy on

May 4, 2015

One of the worst things amortgage shopper can do is assume that alender’s rates are competitive. For evidence of that, look no further than the latest data from ournation’s largest default insurer, CMHC. Itreportsthat borrowers who closed insured 5-year fixed mortgages in the thirdquarter of 2014 paid an average rate of 3.37%. That’s somewhat remarkable when you realize that the...

read more

By The Spy on

April 9, 2015

We see great rates every day, but this deal made us utter “wow” out loud. Meridian’s 1.49% 18-month fixed special is the lowest lender-advertised rate in, well, forever. On a $250,000 mortgage it’ll save you about $4,000—over the first18 months—versus a typical five-year fixed rate. No one’s got that kind of money to burn. Then again, this limited-time offer is...

read more

By The Spy on

March 30, 2015

Here we go. It’s starting. Amid cold-blooded rate competition, the banks are turning on the “feature charm” and touting their mortgage perks. The goal: to shift your attention from their higher rates. And why shouldn’t you? Features, advice and mortgage flexibility really do matter, as mortgage penalty victims routinely find out. But there’s more to it than that. The banks’...

read more

log in

log in