When it comes to getting the lowest mortgage rate, where you live matters.

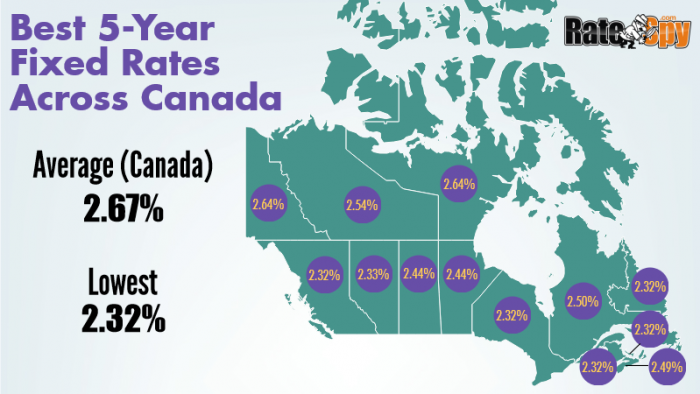

Someone searching RateSpy.com from Halifax, for example, sees 2.49% as today’s lowest 5-year fixed mortgage rate. Meanwhile, someone in Vancouver with the exact same qualifications sees 2.32%.

Both of those rates are clearly exceptional, but 0.17 percentage points is still 0.17 percentage points. We’re talking about $1,593 of interest differential on a standard $200,000 five-year mortgage.

So what gives?

Capital knows no borders, so why don’t lenders offer similar rates across provinces? Here are a few of the key reasons.

More Competition = Lower Rates

Simply put, greater competitive pressure in Canada’s hottest real estate markets (especially Vancouver and Toronto) translates into cheaper mortgage rates.

Ontario is the most competitive by a long shot, with 113 lenders publicly advertising mortgage rates (not including brokers). Compare that to Saskatchewan at 44, for example. The end result: Ontario has more companies vying for the borrower’s attention, and willing to undercut each other to get it.

This factor also extends to individual mortgage brokers, who sometimes use their own commissions to “buy down” rates for clients. Big provinces have hundreds, even thousands, more licensed brokers than smaller provinces. The Internet allows these brokers to do deals all throughout the province.

More and more, brokers in small provinces are getting licensed in big ones, in order to expand their businesses over the Internet. Not surprisingly, these brokers focus on the biggest English-speaking regions: Ontario, B.C. and Alberta. Quebec, by contrast, is harder to do business in (largely because of the language barrier and legal differences) so it gets less competition from outside of its borders.

Scale Helps

Bigger provinces generally have bigger regional lenders. Vancouver is a good example. It has a host of heavyweight credit unions (e.g., Vancity and Coast Capital) that aggressively challenge the banks. Lenders in bigger markets have an easier time generating volume than, say, a lender in Whitehorse where volumes are a flyspeck in comparison.

Of course high population provinces like B.C. and Ontario also have higher home prices. That boosts lending volumes as well.

When combined, higher unit loan sales and bigger mortgage amounts can lead to greater efficiency, better wholesale funding costs, and lower expenses per mortgage. Lenders enjoying these scale benefits can then pass on slightly better rates to borrowers.

Regulation Blocks Competition

Thanks to provincial regulation, credit unions generally only operate within their own province. So if a credit union in Ontario launches a hot promotion (e.g., Meridian Credit Union’s recent 1.69% rate), there is no incentive for a credit union in Quebec to do the same, since they aren’t competing for the same customers.

All this said, no one’s going to switch provinces just to save 0.10 to 0.20 percentage points on their mortgage. But if you do happen to live in a major province, it sure is a nice perk to have.

********

Current Rates By Province

Lowest Rates in British Columbia

Lowest Rates in Newfoundland and Labrador

Lowest Rates in Northwest Territories

log in

log in

8 Comments

Personally I think credit unions are hugely underrated – great rates, good service, why wouldn’t you go with them?

What about brokers buying down rates? Does that have any bearing on the lowest rates that are available in some provinces and not others? Just curious, thanks!

Hey there Tara, Buydowns are more prevalent in the big provinces, particularly Ontario and BC. But that’s mainly because ON and BC have more brokers and bigger populations, and thus more competitive marketplaces in general.

I always knew the cost of living in the north was high – higher cost for consumer goods, food items (esp fruit and veggies), but those are significantly higher mtg rates. If those are the lowest rates for the territories I’d hate to see the avg rate those folks are paying

Kudos to Ratespy for the recently added rates search tools. It’s convenient to search for rates directly within municipalities/cities.

Many thanks Steve. The new city and province pages are in beta at the moment. They’ll be beefed up to include many more providers by next week.

Hey I just noticed that new feature thanks to this comment. Very useful, and nice to see some actual city/province content!

Thx TJ. An official announcement is forthcoming once our mini-beta is done. Glad you like it though. Any related feedback is most welcome.