By The Spy on

January 10, 2020

For some people, minimizing their monthly payments outweighs minimizing interest expense. These people happily pay higher rates to improve their cash-flow. That’s precisely why interest-only (I/O) mortgages exist. And since the beginning of time, they’ve always sold for a premium above conventional mortgages. Today, however, that premium is near a record low. Whereas Canada’s most aggressively priced interest-only mortgage (the...

read more

By The Spy on

January 7, 2020

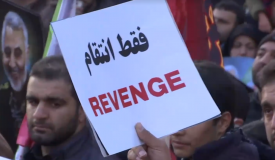

Iran is still miffed about the U.S. exterminating its #1 general. It’s reportedly contemplating 13 potential strategies for inflicting a “historic nightmare” on the American infidels. Apart from ensuring its own devastation, such a move would likely drive down Canadian bond yields. Five-year yields often drop during wartime asinvestors rush for safety in government-guaranteed securities. In the 1990 Gulf War,...

read more

By The Spy on

January 3, 2020

Here’s reason #5,369 why we don’t like to predict interest rates: war. Canada woke up this morning to the leader of Iran’s Revolutionary Guards’ Quds force being incinerated by a U.S. bomb. Iran’s Supreme Leader promised “severe retaliation” — whatever that means — and just like that, bond yields plunged. It was completely unpredictable. When global risk escalates, traders instinctively...

read more

By The Spy on

January 2, 2020

motusbank and Tangerinehave been putting the screws to HELOC competitors for months now. Their respective 3.75% and 3.85% HELOC rateshave undercut almost every lender in Canada since last spring. That’sfar longer than other lenders ever expected (or hoped). The more that consumers learn about these rates, the more it becomes an issue for the major banks. Reason being,HELOCs are usually...

read more

By The Spy on

December 29, 2019

Compared to the chilling regulatory news of 2018 (i.e., the launch of OSFI’s mortgage stress test), this was a year of turnarounds in the mortgage market. For one thing, the year ended with palpable optimism in the housing sector. It was a degree of bullish sentiment that many didn’t think we’d see when 2019 began. Below we recap that and...

read more

By The Spy on

December 27, 2019

Every December, we try to read the tea leaves and prognosticate what’s ahead for real estate lending. (See this year’s2020 mortgage predictions.) It’s always a fun exploit, and this year, unlike most, there’s a good shot that our calls go 5 for 5. One topic that remains a crap-shoot in 2020 is housing appreciation. Canada is entering the year with...

read more

By The Spy on

December 22, 2019

For years, seniors, mortgage advisors and financial professionals have complained that reverse mortgage rates are too high. Well, things are looking up. Last month we saw the biggest one-day drop in the industry’s history with Equitable Bank’s new (much lower) “Lump-Sum Reverse Mortgage” rates. Canada’s lowest reverse mortgage rates dropped 60 basis points in one day when Equitable launched that...

read more

By The Spy on

December 20, 2019

6.2%. That’s how much Canada’s average home price could rise in 2020, according to CREA. The national average home price is already up 8.4% in the last 12 months. A country-wide average doesn’t tell the whole story, of course. The Prairies and Newfoundland are seeing much softer markets. And,economists’ 2020 consensus price growth estimate is just 3%. But given we’re...

read more

By The Spy on

December 18, 2019

Many of you know that the lowest mortgage rates in Canada often require default insurance. Insurance reduces credit risk and losses for lenders, and lenders often pass that savings through to consumers. What many don’t know is how to get insured rates if you already have a mortgage. Consider this example… Suppose youbought a $900,000 home a few years ago...

read more

By The Spy on

December 16, 2019

In 2012, Canadians lost the ability to buy $1 million+ homes with less than 20% down. The Finance Department put the kibosh on it, in its hotly debated quest to “reduce taxpayer risk.” But now, there’s hope that well-qualified borrowers will once again be able to buy a 7-figure shack with just 10% down. Genworth Canada, the nation’s biggest private...

read more

log in

log in