By The Spy on

March 29, 2019

Drain your RRSP further to buy a new home. That’s what the government is encouraging with its newly increased RRSP Home Buyers’ Plan (HBP) limit, which just rose from $25,000 to $35,000. You’ll probably draw your own conclusion as to whether that’s a good idea. We support it in limited cases, with caution. In fact, yours truly used it to...

read more

By The Spy on

March 28, 2019

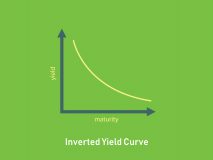

Quick news nuggets from Canada’s mortgage rate market: Not only has the yield curve inverted, but in some cases the mortgage rate curve has inverted. Among uninsured mortgages available in multiple provinces, for example, thebest 5-year fixed rateis now belowthebest variable rate. There’s still tremendous value in insured variable rates—now effectively as low as 2.54% in some provinces. Markets are...

read more

By The Spy on

March 27, 2019

When Scotiabank announced its new “digital mortgage” offering called eHOME, we thought to ourselves, “Oh, how grand, another glorified online application from a big bank.” But after digging into this thing a little, we have come away genuinely impressed. Scotiabank’s eHOME app is officially the best online mortgage experience we’ve reviewed to date. The bank took some risks with this...

read more

By The Spy on

March 25, 2019

It turns out TD Canada Trust’s “market-moving rate cut” won’t be so market moving, at least not yet. On Sunday, TD slashed a number of fixed rates on its website. Today it un-slashed them, saying: “Changes to our posted rates on our website were made in error. We apologize for any misunderstanding and please refer to the rates currently posted.”—TD...

read more

By The Spy on

March 24, 2019

The Canadian yield curve has officially inverted and that’s bearish for mortgage rates. An “inverted yield curve” (in this context) means that the interest rate on almost every Canadian government bond is now below the Bank of Canada’s 1.75% overnight rate. That’s pretty rare. Why it Matters Inverted yield curves are a danger sign. In a normal economy investors like...

read more

By The Spy on

March 20, 2019

Summary: The CMHC Shared Equity Mortgage comes up short, based on the info the government has graced us with thus far. Some of these projections may change, however, as the government releases more information on the programs. OK, someone please tell us our numbers¹ are wrong, because from where we sit the First-Time Home Buyer Incentive (FTHBI) just announced by...

read more

By The Spy on

March 19, 2019

After all the build-up, Canada’s federal budget is finally here. There was no easing to maximum mortgage amortizations or the mortgage stress test, as some had expected. What the government did was throw Canadian mortgage shoppers two bones, with lots of strings attached. Here’s a detailed look at two of the ways the Liberal government proposes to “ease” housing affordability....

read more

By The Spy on

March 18, 2019

Canadian interest rates are still sliding. On Monday, Canada’s5-year bond yield—which drives fixed mortgage rates—closed in the 1.50% range, something it hasn’t done since November 2017. Dozens of lenders have trimmed fixed rates in recent days as yields keep tumbling. And big banks are not excepted. With skidding home sales, weakening property values and mortgage growth near multi-decade lows, the...

read more

By The Spy on

March 15, 2019

Equitable Bank has slashed its reverse mortgage rates. That’s welcome news for seniors needing to tap home equity, particularly those who can’t qualify for regular financing or don’t want the payments. The company—which has remained in HomeEquity Bank’s shadow—is now working noticeably harder to separate itself from its better-known rival. And its rate cuts this week do just that, assuming...

read more

By The Spy on

March 14, 2019

Some big banks want to buy your mortgage business, literally, with cash. HSBC, CIBC and BMO are all “giving away” money. Here’s a quick run-down of their offers: HSBC Cash offer: $1,000 for $200,000 to $499,999.99 mortgages $2,000 for $500,000+ mortgages Available on all 5-year closed terms CIBC Cash offer: $1,000 for $100,000 to $299,999.99 mortgages $1,200 for $300,000 to...

read more

log in

log in